How does the new Income Tax Act affect the 3rd pillar?

A 3rd pillar pension is a great way of putting money aside for the future, because it’s the only saving solution where you get your income tax back on the amount you pay in each year.* But since a new Income Tax Act came into effect at the start of 2018, let’s take a look at the impact it has on the taxation of the 3rd pillar.

What’s stayed the same?

- Nothing has changed in terms of making payments into the 3rd pillar, and you’ll still get your income tax back on the amount you’ve saved. Take a look at how much income tax you could get back from the state.*

- 3rd pillar payouts are still taxed at the rate of either 20% or 10%.**

- Lifelong payouts from the 3rd pillar are not subject to income tax.

What’s changed?

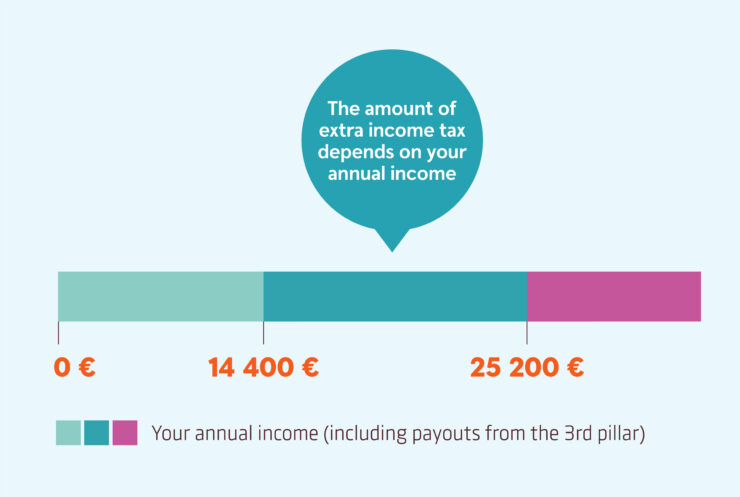

Starting from 2018, the basic exemption is 500 euros per month, i.e. 6000 euros per year. Your basic exemption is calculated on the basis of your gross income for the year (annual income). Payouts from the 3rd pillar form part of your annual income. As such, these payouts could reduce your basic exemption for the year and lead to you having to pay additional income tax to the state. If you want to draw on money from your 3rd pillar, it’s important to keep in mind how it will affect your annual income. We recommend calculating whether you’re better off withdrawing a larger amount all in one go or staggering your payouts throughout the year.

There are two ways you might have to pay extra income tax:

- if your gross annual income without 3rd pillar payouts is up to 14,400 euros and your annual income exceeds this amount because of the payouts; or

- if your gross annual income without 3rd pillar payouts is from 14,400-25,200 euros and you withdraw money from the 3rd pillar.

You won’t have to pay extra income tax if your gross annual income with 3rd pillar payouts is up to 14,400 euros. Nor will you have to pay any extra if your gross annual income is greater than 25,200 euros, since in that case the basic exemption is 0.

Did you know…?

If you’ve decided to start using the money you’ve saved in the 3rd pillar, think about your gross annual income and choose whichever way of making payouts will leave you best off financially. You can find out more about the basic exemption online at https://www.emta.ee/et/maksuvaba-tulu.

*You can get income tax back on payments into the 3rd pillar that form up to 15% of your gross annual income but no more than 6000 euros during the calendar year.

**Starting from the age of 55, if you’ve been saving for at least five years or in the case of an investor who is unable to work, payouts are taxed at the rate of 10%.

Swedbank’s pension funds are administered by Swedbank Investeerimisfondid AS and pension insurance with investment risk is offered by Swedbank Life Insurance SE. Prior to making a decision, review the prospectuses and terms and conditions. Where necessary, consult a specialist.